High cost of higher education

Graphic by Cassidy Schmidt

March 23, 2022

Jensen Peacock opens up her laptop and logs into her DePaul student account. Staring back at her is a five-figure sum of money she owes in expenses for college.

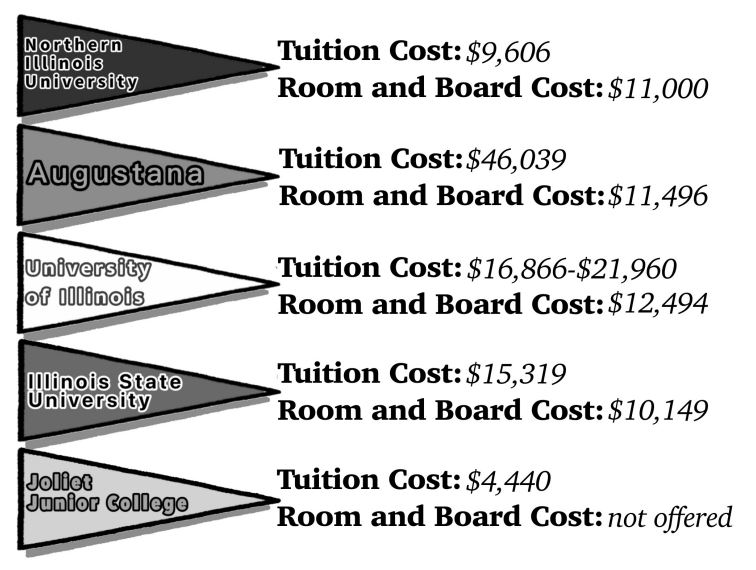

The price of education is not cheap. Without financial aid, a college degree can cost thousands of dollars.

“By 2017, the total number of applications had more than doubled to almost 10.2 million, or 6.8 per enrolled student,” said Drew Desilver, a senior editor from Pew Research Center.

A deciding factor for the applicant often comes down to cost. Cost can often be the reason students don’t go to the school they had hoped to attend.

“Cost can be prohibitive for some students to get into college,” Associate Principal of Curriculum and Instruction Stan Bertoni said.

According to admissions.illinois.edu, the University of Illinois can run up to $38,154 for in-state students and up to $55,944 for out-of-state students. This price point is unrealistic for many students, but there are options to decrease the cost of college. Student loans, grants and scholarships are all ways that a student can decrease their expenses.

Public schools are often viewed as the more affordable option, yet private schools tend to hand out more scholarships and give out more money than public schools.

“I honestly never even looked into private colleges, I always thought they were unnecessarily expensive,” University of Illinois freshman Devon Vanlaningham said.

Any student who meets the criteria for scholarships can receive a scholarship or grant. All they have to do is apply.

“Each year, an estimated $46 billion in grants and scholarship money is awarded by the U.S. Department of Education and the nation’s colleges and universities,” said Max Fay, a personal finance writer for debt.org.

Students can earn grants, which are sums of money put toward their college that they don’t have to pay back. They can also get scholarships, which are earned from their achievements.

“I received $16 thousand in scholarship money from DePaul, which is what convinced me to go for the most part,” said DePaul junior Jensen Peacock.

In order to receive financial aid and grants, students must apply for Free Application for Federal Student Aid, or FAFSA. In order to apply, a student must go onto the FAFSA website and apply every year.

“When filling out the FAFSA annually, low income families often qualify for federal student aid in terms of grants and loans.” College and Career Counselor Elaina Kalantzis said.

According to a survey filled out by 73 high school seniors, 62 percent have applied for financial aid and 74.7 percent plan on applying for financial aid.

Students who come from low income families are often granted scholarships or decreased tuition because their family’s economic status qualifies them for financial aid.

“The FAFSA is used to determine your financial need and can qualify you for need-based loans and grants.” said Fay

Junior colleges are also a cost- effective option for students who can’t afford the tuition that comes with a four- year university. Junior Colleges help students meet the minimum requirements for college credits and help them transition into a four-year college.

According to niche.com, “tuition for Frontier Community College in Illinois is $6,747.”

Doing the correct research will ensure the school that a student selects is the best school for them. The school should be a good financial, social, geographical and academic fit for the student.

“I chose to go to DePaul because they offered me a scholarship and living in the city would be an easier adjustment,” Depaul junior Jensen Peacock said.

Touring colleges and meeting with alumni are ways to get a feel for the school and not waste money, because the student will know they’re at the right school for them and not feel the need to switch mid-way through. Switching schools can potentially be more expensive because there is always the chance that credits won’t transfer, meaning the student would have to make up that credit.

“If they are interested in schools, make sure they visit the campus, talk with admissions and program representatives, review the majors offered and overall cost of attendance.” Kalantzis said.